intuit payments

Wiki Article

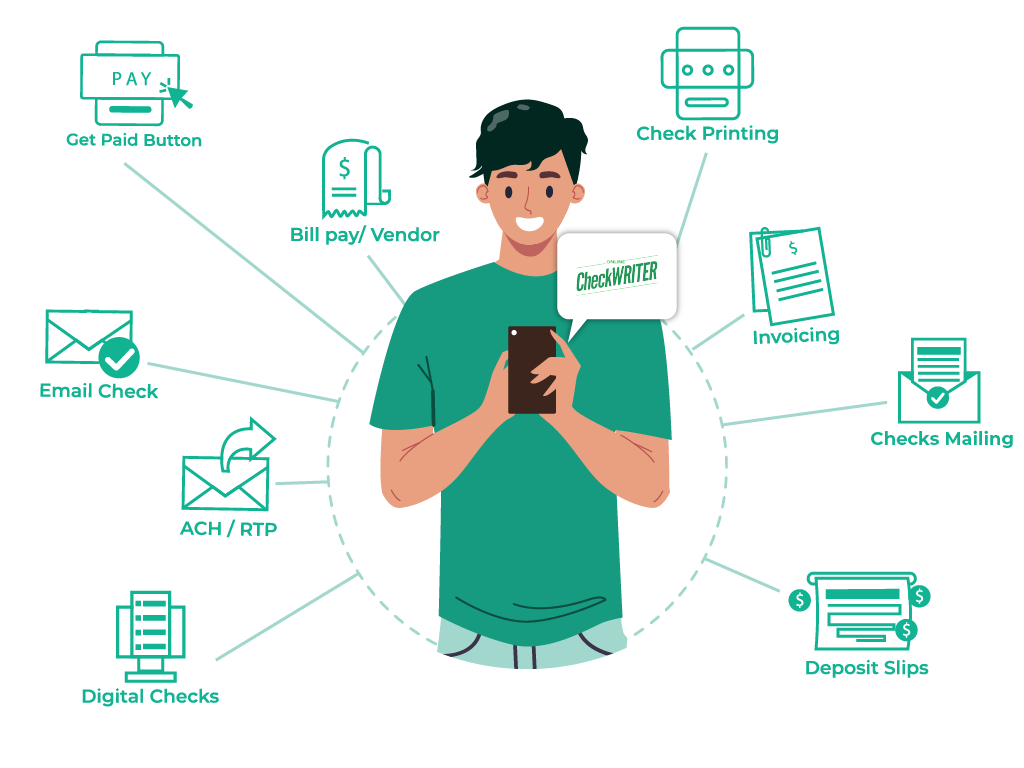

Intuit Payments, along with OnlineCheckWriter.com, lets you handle payment processing and accounting seamlessly. You can easily import checks, bills, and invoices. Using our all-in-one platform, you can print checks, send eChecks, and process ACH, credit card payments, and RTP quickly and securely. All activities are protected with the latest security features.

In today's fast-paced digital world, businesses need efficient and secure payment solutions to stay competitive. Intuit Payments, a leading financial technology company, has emerged as a reliable and innovative platform that simplifies transactions for businesses of all sizes. With a seamless user experience and a wide range of features, Intuit Payments offers a one-stop solution for payment processing needs. In this article, we will explore the key benefits and unique features of Intuit Payments that make it stand out in the ever-evolving payment processing landscape.

A Versatile Payment Processing Platform

Intuit Payments is designed to cater to the diverse needs of businesses, from small startups to large enterprises. Whether you need to accept payments online, in-store, or on-the-go, Intuit Payments has got you covered. Its comprehensive suite of solutions includes credit and debit card processing, ACH payments, and mobile payments, enabling businesses to offer their customers a variety of payment options. This versatility ensures that businesses can reach a wider audience and accommodate their customers' preferences, leading to increased sales and customer satisfaction.

Seamless Integration with QuickBooks

One of the most significant advantages of Intuit Payments is its seamless integration with QuickBooks, Intuit's renowned accounting software. This integration streamlines financial processes for businesses, eliminating the need for manual data entry and reducing the chances of errors. The synchronization between Intuit Payments and QuickBooks ensures that transactions are automatically recorded, invoices are updated in real-time, and financial reports are generated accurately. As a result, businesses can save valuable time and focus on growing their operations without worrying about tedious administrative tasks.

Enhanced Security and Fraud Protection

Security is a paramount concern in the world of digital payments, and Intuit Payments prioritizes safeguarding its users' sensitive information. The platform adheres to industry-leading security standards, incorporating encryption, tokenization, and multi-factor authentication to protect against unauthorized access and data breaches. Additionally, Intuit Payments employs advanced fraud detection measures, monitoring transactions in real-time to identify and prevent fraudulent activities. By providing robust security features, Intuit Payments instills trust in both businesses and their customers, encouraging repeat transactions and fostering long-term relationships.

Easily Accessible Reporting and Analytics

Understanding your business's financial performance is vital for making intuit payments informed decisions and devising growth strategies. Intuit Payments offers a user-friendly reporting and analytics dashboard that provides valuable insights into transaction patterns, revenue trends, and customer behavior. Business owners can access these reports anytime, anywhere, enabling them to stay informed and proactive. By having access to detailed data, businesses can identify opportunities for improvement, optimize pricing strategies, and enhance overall operational efficiency.

Excellent Customer Support

When it comes to critical financial services, having intuit payments reliable customer support is essential. Intuit Payments excels in this regard, offering excellent customer service to assist businesses whenever they need help. Whether it's a technical issue, a billing inquiry, or general guidance, Intuit's dedicated support team is readily available intuit payments to address concerns and provide prompt solutions. The availability of reliable support ensures that businesses can maintain smooth payment processing operations, minimizing disruptions and maximizing customer satisfaction.